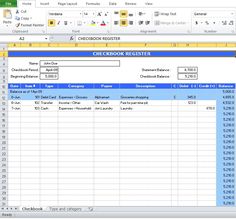

Free Personal Finance Software. Download Includes Easy Checkbook RegisterIn addition, each check will also include the bank’s routing number, the account number, and the check number. Sometimes the money may be out of your account the same day you write a check.If you miss a transaction you could end up writing a check for more money than you have in the bank. Usually when you open a checking account, the person from the bank helping you will give you a checkbook. You can order more checks from the bank or from a company that prints checks. You can order checks with different backgrounds such as your favorite sports team, animals, or the beach.Ordering checks for the first time is a simple and easy process. You can order checks from your bank through their mobile banking app, website, by phone, or in person. Alternatively, you can order personalized checks from third-party companies online. If you’re buying third-party checks, it’s best to check if your bank has preferred vendors, since these might have a special discount. You can order regular single page checks or duplicate checks, which give you an instant copy of the check for your personal records.

Checkbook accounting vs. real accounting

At the end of the day, the store sends the checks to the local bank. The value of the check is encoded into numbers at the bottom of the check. Then the check is run through a very fast reader/sorter machine. This information is then sent electronically to the Federal Reserve clearinghouse.

What is Cheque in accounting?

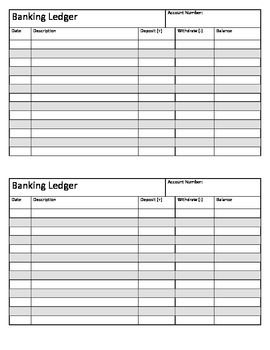

A cheque is an authorization to draw funds from a bank account. In order to do this, a cheque must state the name of the payee, the amount to be paid, and the date. However a cheque can also be written to cash, which means that payment will be made by the bank to whomever presents the cheque.Inside the checkbook you will also have some deposit slips. You can fill this out ahead of time before you go to the bank to help make your trip to the bank faster. This is where you record events in your checking account such as checks you’ve written, cash withdrawals, and deposits. It’s very important to write down every transaction so you know exactly how much money you have in the bank.

How do you get a checkbook?

A checkbook is a folder or small book containing preprinted paper instruments issued to checking account holders and used to pay for goods or services. A checkbook contains sequentially numbered checks that account holders can use as a bill of exchange.

How to Open a Checking Account Online

In both cases, make sure to have all your important account information available to give to the representative or bank teller. Complicated software insist that you can save time by downloading your checkbook transactions from your bank. When you don’t enter your daily transactions to find your actual spending balance, you run the risk of overdraft.My Checkbook enforces good personal finance accounting by letting you quickly enter your daily transactions so you know what you’ve really spent! Don’t let outstanding checks or ATM/Debit transactions fool your bank’s balance and cost you overdraft fees. When you balance your accounts, it shows you much money you actually have an available. This will leave you with the end balance on a given date so that a current balance can be calculated at any time.For example, you might need to provide avoided checkfor setting updirect deposit, or you might have a one-off situation that requires a paper check. Banks usually offer small quantities of checks with your account information printed on them for a small fee. Call ahead and ask if it’s possible to get a counter check before you make a trip to the branch. Other alternative software vendors also can help you create checks. For example, the cloud-based accounting program Xero allows you to customize a check design and add bank information in MICR format, then print the check.

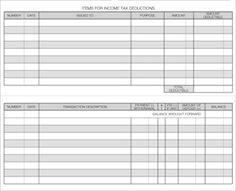

- Inside the checkbook you will also have some deposit slips.

- This is where you record events in your checking account such as checks you’ve written, cash withdrawals, and deposits.

- You can fill this out ahead of time before you go to the bank to help make your trip to the bank faster.

The Obsolescence of Checkbooks

Despite becoming obsolete, checks do provide some advantages. Often in the fast-paced digital world, we pay for transactions and then forget about them.

How do you balance a checkbook?

From there your bank sees the check and pays the amount to the store. If you just need a single check and don’t want to go through the hassle of printing one yourself, your bank might be able to give you a counter check.You’ll also want to double-check your order before making it final. While printers typically verify your account details with the bank before printing, checks with the wrong account information on them aren’t very useful.

How a Checkbook Works

Most likely, you will need to pay for your order online using a credit or debit card. You’ll just need to have your checking account, routing number, and bank information when ordering checks online. If you feel uncomfortable ordering checks online, you can also order by phone or at the bank.

MoneyLine Personal Finance Software

This can lead to cutting out unnecessary costs and saving more. A checkbook is comprised of a series of checks that can be used to make purchases, pay bills, or in any other situation that requires payment. With the advent of online commerce and banking, more people are making purchases and paying bills online, thereby reducing or eliminating the need for paper checkbooks. If you have pre-printed checks with MICR line, you can use any printer. If you need to print checks on blank stock, we suggest MICR (Magnetic Ink Character Recognition) printers and laser printer.

Personal Finance

A checkbook is a folder or small book containing preprinted paper instruments issued to checking account holders and used to pay for goods or services. A checkbook contains sequentially numbered checks that account holders can use as a bill of exchange. The checks are usually preprinted with the account holder’s name, address, and other identifying information.When ordering your checks, you’ll need your routing number and bank account number, which will be printed on your checks. It will generally take between 1 and 2 weeks to receive your checks, although some companies offer expedited shipping. With the advent of the digital age, checkbooks have become obsolete. A person can have a checking account without ever actually having to write a check. On rare occasions a check is still required, such as paying rent, which requires writing a check out to your landlord.